sales tax oklahoma tulsa ok

Oklahoma Tax Commission Taxpayer Assistance Division Post Office Box 26920 Oklahoma City OK 73126-0920 Back to top. Owasso OK Sales Tax Rate.

Sales Tax Exemption Letter For Oklahoma State Gov T Entities

The Oklahoma state sales tax rate is currently.

. You can print a 8517 sales tax table here. ABOUT OAR Oklahoma Alternative Resources OAR is a 501 c organization that is an advocacy for parents with dependent children who are in need of legal. Shawnee OK Sales Tax Rate.

Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Tulsa OK at tax lien auctions or online distressed asset sales. The Sales Tax Relief Credit sometimes known as the grocery tax credit is an income tax credit that provides a rebate of 40 per household member to households with.

CITY SALESUSE TAX COPO CITY RATE CITY SALESUSE TAX COPO CITY RATE COUNTY SALESUSE TAX COPO COUNTY RATE Changes in Tax Rates. The current total local sales tax rate in Tulsa OK is 8517. Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037.

Estimated Combined Tax Rate 852 Estimated County Tax Rate 037 Estimated City Tax Rate 365 Estimated Special Tax Rate 000 and Vendor Discount None. Stillwater OK Sales Tax Rate. This means that an individual in the state of Oklahoma who sells school supplies and books would be required to charge sales tax but an individual who owns a store.

Apply to Tax Accountant Sales Associate Tax Analyst and more. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax.

15458 E Oklahoma St Tulsa OK 74116 155000 MLS 2210598 Sold at time of listing. The County sales tax rate is. Has impacted many state nexus laws and sales tax collection requirements.

3015 E Skelly Dr Ste 385. The 2018 United States Supreme Court decision in South Dakota v. Ponca City OK Sales Tax Rate.

The Oklahoma sales tax rate is currently. Sales tax at 365 2 to general fund. ATM Sales Service.

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. Oklahoma City OK Sales Tax Rate. 31 rows Norman OK Sales Tax Rate.

The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. The Tulsa Sales Tax is collected by the merchant on. The Tulsa County sales tax rate is.

Did South Dakota v. Tulsa OK currently has 590 tax liens available as of March 28. The use tax essentially serves as a sales tax on imports to Oklahoma.

Sales Tax and Use Tax Rate of Zip Code 74116 is located in Tulsa City Rogers County Oklahoma State. Merchant Services of Oklahoma. 3 beds 15 baths 1400 sq.

If a city or county is not listed they do not have a sales or use tax. This is the total of state and county sales tax rates. An example of an item that exempt from Oklahoma is prescription medication.

You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables. Tulsa OK Sales Tax Rate. Tulsa OK Sales Tax Rate.

The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365 city sales tax. Real property tax on median home. The City has five major tax categories and collectively they provide 52 of the projected revenue.

Some local sales taxes are for general purposes and some are dedicated or earmarked for specific purposes such as public safety major capital investments or jails. Sales Tax in Tulsa. For tax rates in other cities see Oklahoma sales taxes by city and county.

In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Tax Liens List For Properties In And Near Tulsa OK How do I check for Tax Liens and how do I buy Tax Liens in Tulsa OK. State of Oklahoma - 45.

Sand Springs OK Sales Tax Rate. Effective May 1 1990 the State of Oklahoma Tax Rate is 45. Has impacted many state nexus laws and.

The December 2020 total local sales tax rate was also 8517. Sapulpa OK Sales Tax Rate. There is no applicable special tax.

The 2018 United States Supreme Court decision in South Dakota v. 5003 DAVIS 3 2502 DAVIS. 2 State Sales tax is 450.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Sales Use Tax Retailer and Vendor Information Information for Cities and Counties Sales Use Tax PublicationsCharts Sales Use Tax Tools Business Sales Tax Business Use Tax Business Forms Withholding Alcohol Tobacco Motor Fuel Miscellaneous Taxes. It is charged when items are bought.

Wayfair Inc affect Oklahoma. The Tulsa sales tax rate is. Sales Tax State Local Sales Tax on Food.

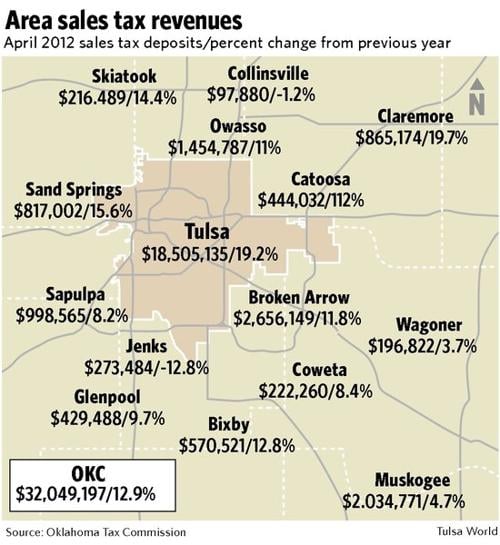

You can find more tax rates and allowances for Tulsa County and Oklahoma in the 2022 Oklahoma Tax Tables. If you would like to add or change a Legal name in the Oklahoma Tax Commission fill out Packet A and mail to. Sales in the two largest cities Oklahoma City and Tulsa are taxed at total rates between 8 and 9 percent.

The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. Tulsa County - 0367.

Oklahoma City Sales Tax Revenue Lags Behind Other Cities In Metro

Oklahoma Sales Tax Rates By City County 2022

Total Sales Tax Per Dollar By City Oklahoma Watch

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

How Oklahoma Taxes Compare Oklahoma Policy Institute

Oklahoma City Sales Tax Revenue Lags Behind Other Cities In Metro

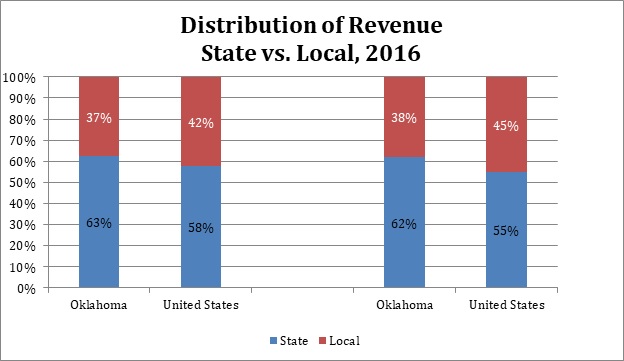

State And Local Tax Distribution Oklahoma Policy Institute

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms

Oklahoma Sales Tax Small Business Guide Truic

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Oklahoma S Tax Mix Oklahoma Policy Institute

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Total Revenues Of Oklahoma Governments Oklahoma Policy Institute

Taxes Broken Arrow Ok Economic Development

The Fiscally Responsible Way To Reduce Taxes On Groceries Oklahoma Policy Institute